Even if you don't love watches, You've probably heard about the 39% tariff the U.S. government imposed on Swiss watches.

Trump Unveils Tariff Plan With Chart at Press Briefing

© Demetrius Freeman/The Washington Post

While headlines frame new tariffs as a body blow to the industry, they also hand watchmakers a convenient pretext for aggressive price hikes. That won’t thrill most enthusiasts. But will profit-driven brands truly prioritize enthusiast sentiment? Tariff-linked increases aren’t just cost pass-throughs; they can be a deliberate play to anchor higher MSRPs, reinforce perceived scarcity, and “manufacture” value durability.

Rendering of the new Rolex factory / © Rolex

Luxury fashion has largely exhausted narrative-heavy branding and now leans on intuitive, price-led signaling. Luxury watches still trade on storytelling—but without tariff relief, brands may follow fashion’s playbook. In that frame, steep price increases aren’t mere cost pass-throughs; they can be a strategic separator: anchoring higher MSRPs, amplifying scarcity, and manufacturing value durability. The paradox: what frustrates enthusiasts can fortify brand tiers and resale perception. The question is whether watchmakers will accept short-term community backlash to secure long-term pricing power and a sharper, more differentiated image.

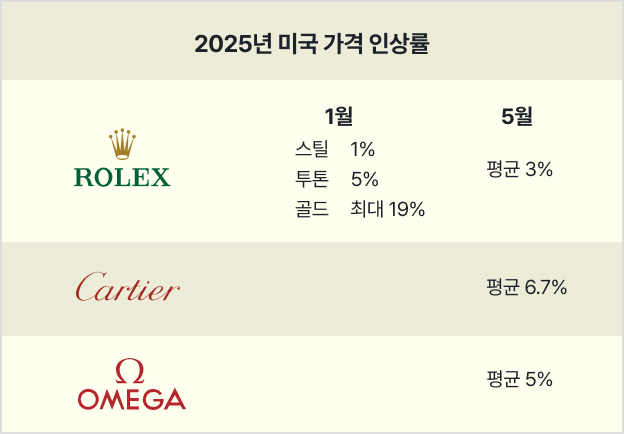

Steep Price Hikes Are Here: What It Signals

The risk of Trump’s tariffs was flagged as early as late last year. In 2025, major brands—including Rolex, Omega, and Cartier—have already executed sizable cumulative price hikes. While framed as defensive, these moves also function as price signaling: anchoring higher MSRPs, compressing tier gaps, and reinforcing scarcity—often at the expense of enthusiast goodwill.

© Watch Terminal

This isn’t just list-price inflation. Brands are lifting portfolio averages by proliferating variants in core lines, launching limited editions, and introducing new models at materially higher MSRPs—ratcheting the entire price ladder up. Rolex's new releases Land-Dweller, The Omega Seamaster Diver 300M—with its ever-expanding catalog of materials, colorways, and collabs—and Cartier’s ultra-limited runs are textbook mix-shift tactics that lift average prices without overt list hikes.

© Watch Terminal

Watchmakers' Response Strategies: What History Tells Us

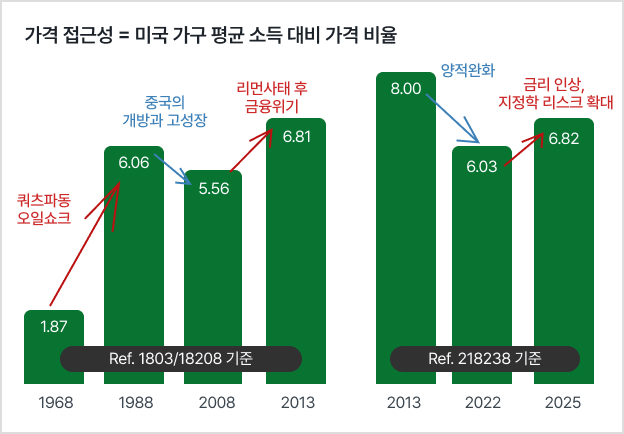

The watch industry is no stranger to crisis. In the 1970s—amid the quartz revolution and the oil shock—brands that chased volume and affordability saw their brand equity collapse, in some cases to the brink of extinction.

© Watch Terminal

Explosive demand for quartz watches forced mainstream brands to pivot—rapidly launching quartz variants across their core lines and, in many cases, full quartz lineups.

© Brother

© Craft and Tailored, Patek Philippe

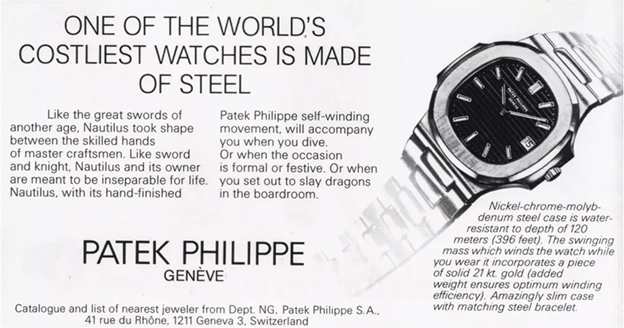

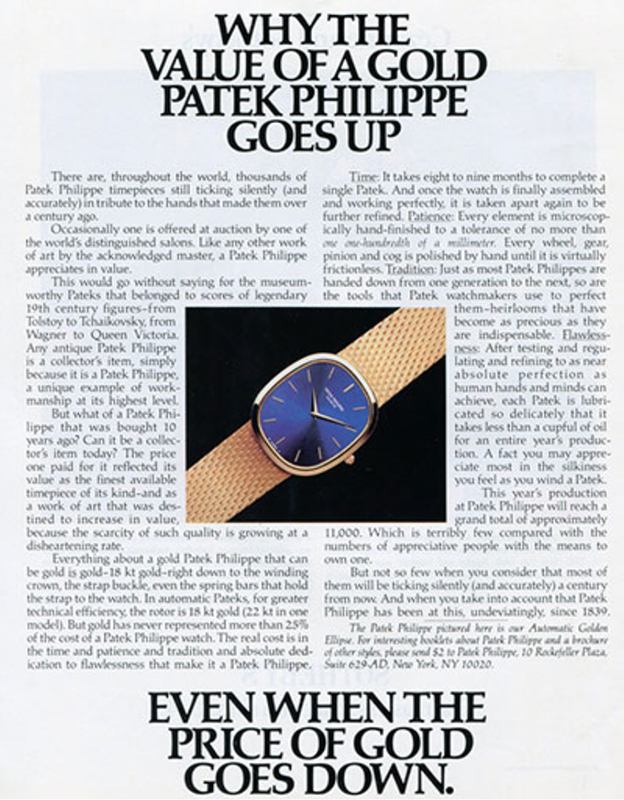

By contrast, brands that doubled down on an up-market strategy—raising prices while tightening access—have secured unrivaled status, notably Patek Philippe and Audemars Piguet. Since the quartz crisis, mechanical watches have increasingly behaved like Veblen goods: the classic downward-sloping demand curve doesn’t fully apply at the high end. Here, price functions as a signal—of scarcity, craftsmanship, and cultural capital—so lifting prices can amplify exclusivity rather than suppress demand.

© Collectability, Patek Philippe

When the economy softened and sales slowed, most categories discounted. Top watchmakers did the opposite: they tightened access and raised prices—often outpacing income growth—to signal scarcity and defend brand equity. The objective wasn’t a short-term mark-up; it was to preserve 100–150 years of maison heritage, protect resale perception, and entrench long-run pricing power.

Source: U.S. Census Bureau, Minus4Plus6, Rolex

© Watch Terminal

Since 2022—after the post-pandemic liquidity surge—leading watchmakers have replayed the classic luxury playbook: tight allocation, mix-shift to higher-margin references, and deliberate price steps. The signal is intentional: “our clients are recession-proof.” It’s a posture designed to defend brand equity, protect resale perception, and sustain pricing power through the cycle.

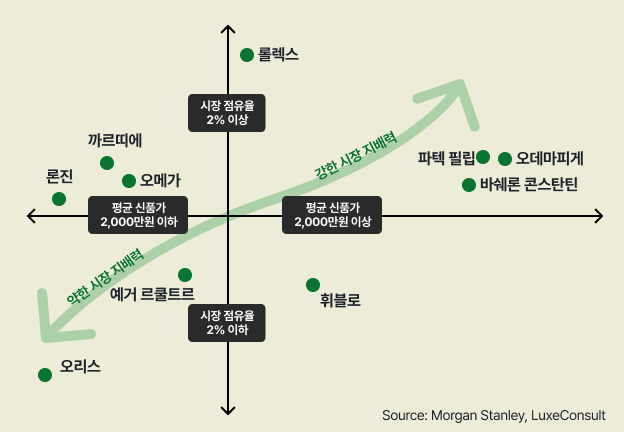

In the mid-level, Separating the wheat from the chaff

As affordability erodes at market-power houses like Rolex and Cartier, a window opens for brands just below them by market share (not price or “prestige”). Displaced, aspirational buyers will trade across rather than down if challengers offer credible movements, coherent hero models, controlled availability, and transparent ownership economics (CPO, service, buyback floors). This is a rare moment to convert priced-out demand into long-term brand equity.

© Watch Terminal

Seizing this opening depends on storytelling that makes your heritage legible and compelling. Incumbents with entrenched recognition will keep leaning into premium pricing; challengers must carve a distinct position through narrative—anchoring craft, provenance, and a clear point of view—so higher prices read as signal of value, not margin grab.

Impact on the Korean domestic market 1

Double squeeze: rising watch prices and hostile FX are adding insult to injury for buyers.

New watch MSRPs are set to rise faster domestically than overseas, widening gaps, boosting CPO demand, and pressuring channels with grey-market risk.

© Watch Terminal

Domestic importers of new watches are now passing through global price hikes and FX moves (KRW–USD, KRW–CHF) to retail far more quickly than before. The old lag—when distributors absorbed costs or adjusted gradually—has largely disappeared.

Swiss Franc to South Korean Won Exchange Rate (as of August 13, 2025)

© Investing.com

Softening domestic demand from reduced price accessibility might be partially offset by inbound shopping tourism. But if gross margin (retail price minus cost) is sacrificed to chase volume, break-even or outright losses become unavoidable.

Domestic Market Impact 2

Positive in terms of quantity and diversity

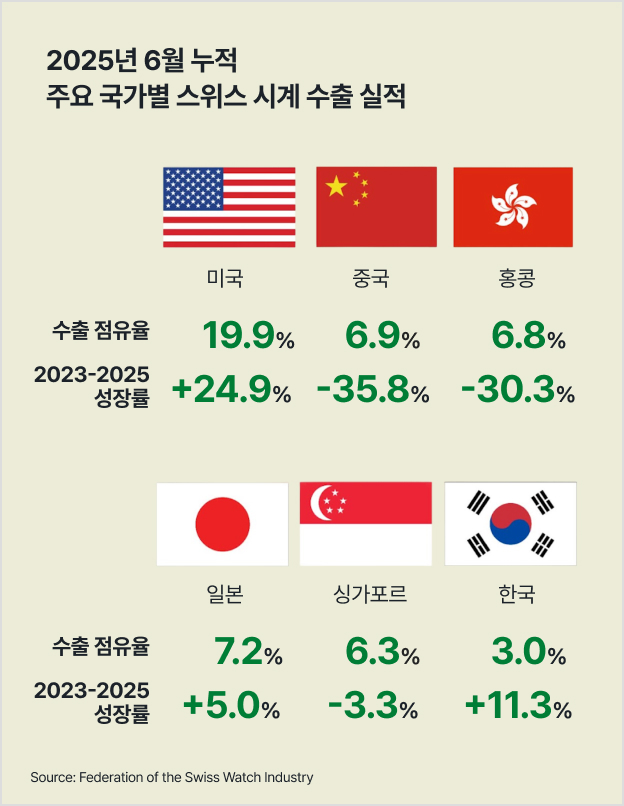

On the supply side, U.S. tariffs could be mildly positive for the domestic watch market: softer U.S.-bound demand may free up brand allocations to Korea, easing scarcity and shortening waitlists. At the same time, the three largest global markets—China, the U.S., and Hong Kong—face regulatory headwinds that are already cooling demand in China and Hong Kong, potentially redirecting additional inventory to our market.

© Watch Terminal

While the macro downturn played a role, sustained anti-luxury measures—e.g., China’s rectification campaigns—have driven a sharp two-year drop in Swiss-watch imports to China and Hong Kong. The resulting allocation slack is a rebound tailwind for Korea, improving availability and shortening waitlists as inventory is re-routed.

Korea is emerging as Asia’s new fashion hub, serving both domestic and inbound demand. Luxury maisons—Vacheron Constantin, Audemars Piguet, Jacob & Co., Rolex, H. Moser & Cie., TAG Heuer—are racing to expand in Seoul, underscoring the city’s rise as a regional flagship market.Open a boutiqueThe reason for this is precisely because of this market potential.

Bottom line: This may be your last real chance

You’ve heard the cliché—“watches are cheapest today.” Yet some references keep trading briskly even as prices rise, because scarcity is credible, allocation is tight, and resale spreads stay narrow. For collectors who understand Korea’s unique position (allocation shifts, inbound demand, KRW–USD/CHF) and can read global pricing signals early, 2025 is an inflection year. The edge belongs to those who act on data, not anecdotes.

David Hwang

watch analyst

Watch Terminal