This year, The watch market has been full of controversy and turbulence. The United States, The world's largest watch market, Imposed a 39% tariff on Swiss imports, Creating tension throughout the industry. Trade conflicts and financial market uncertainties have further dampened consumer sentiment. As a result, Consumers have become even more discerning in their evaluations. Even in such an environment, The watches that were chosen must have had something truly special. What was the difference between the brands that were selected and those that were not?

Who buys watches in times like these?

Before discussing which watches sold well, We must first consider who is still buying watches in this situation. The answer is clear. Even in a recession, Those who have the financial means to purchase watches and, Above all, Those who truly love and understand watches—the 'collectors'.

© Courtesy of Phillips

Typically, When we think of a 'collector', We imagine someone who collects many watches (or art, Wine, Etc.), And this is often the case. However, There are characteristics more important than quantity:

· They regularly consume content related to watches

· They can evaluate the quality and technical prowess of a watch based on extensive experience

· They have a clear understanding of the value elements that matter most to them

Aurel Bacs, Nicholas Foulkes, And other auctioneers and experts roundtable

Patek Philippe and Rolex – The 'Safe' Choice

Nautilus 5711 / © Watch Club

Despite the difficult economy and rising retail prices due to tariffs, There are watches that people continue to seek out. Thanks to decades of steady increases in resale market prices, These watches are highly liquid. Even those unfamiliar with watches immediately recognize the identity of these watchmakers—Patek Philippe and Rolex.

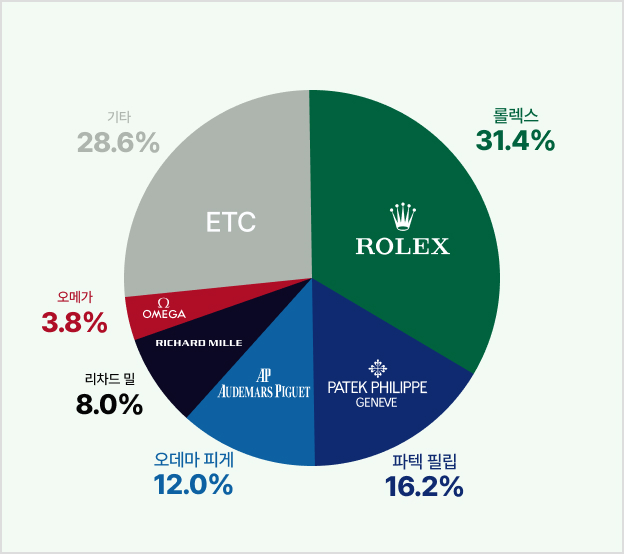

Q3 2025 Resale Market Share (by Transaction Value)

Source: EveryWatch

Rolex accounted for 31.4% of global secondary market transactions in Q3, A figure similar to its share in the new product market. In addition, The number of transactions and the median price in Q3 rose by 17.4% and 2.6% respectively compared to the previous quarter, Outperforming the market average (7%, 2.6%).

Daytona 'Le Mans' 126529LN, 126528LN

© Hodinkee

Daytona 126500LN

40mm, White, Oyster

Daytona 126500LN

40mm, Black, Oyster

Among Rolex models, The Daytona had the greatest impact on transaction value and price increases. In particular, The older steel Daytona, Known as the 'Ceratoner' ref. 116500LN, Accounted for the highest proportion of Daytona transactions. The sharp rise in gold prices also led to a notable increase in the price of the Day-Date 40, With the current ref. 228235/228238 references having the highest transaction share.

Day-Date 40 228238 / © Watch Club

Day-Date 40 228235

40mm, Olive Green/Roman, President

Day-Date 40 228238

40mm, Champagne/Diamond, President

Next is the ever-reliable Patek Philippe. In Q3, Patek Philippe recorded a 16.2% share of the global secondary market, Far exceeding its 5-6% share in the new product market. During the same period, The number of transactions and resale prices increased by 20.6% and 4.1% respectively compared to the previous quarter.

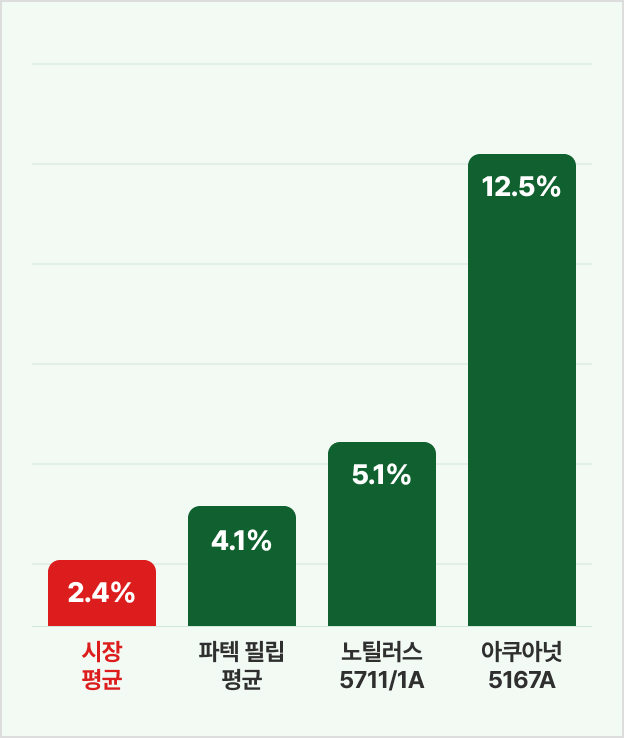

Patek Philippe Resale Price Increase Rate in Q3 2025

Source: WatchCharts

In particular, The representative models of the Aquanaut and Nautilus, 5167A and 5711/1A, Saw their prices rise by 12.5% and 5.1% respectively during Q3, With shortages observed not only in Korea but also in major markets such as the United States and Hong Kong. As of December, Nautilus and Aquanaut remain strong, With prices continuing to rise.

Aquanaut 5167A

40.8mm, Black

Nautilus 5711/1A-010

40mm, Blue

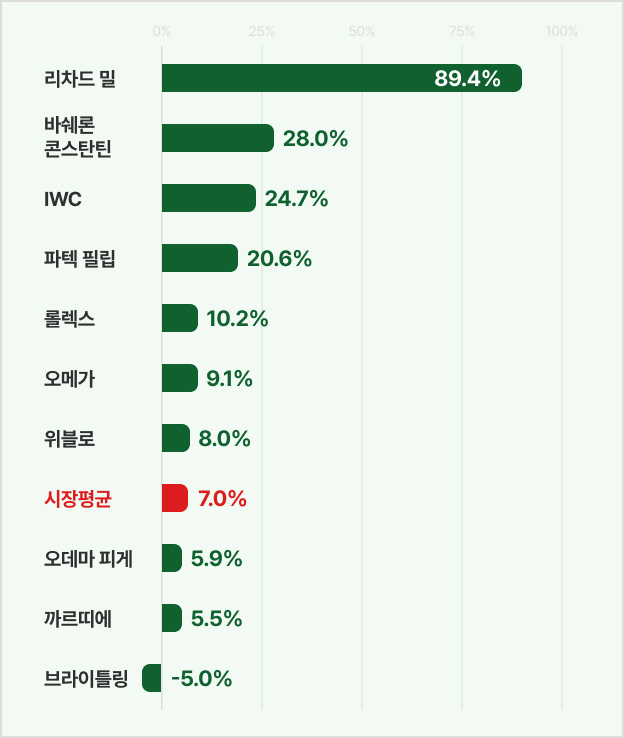

Q3 2025 Brand Resale Market Transaction Growth Rate

Source: WatchCharts

It has already been three and a half years since the pandemic bubble burst, Yet Rolex's 'resale premium' remains around 17%. Especially popular models such as the Daytona and GMT-Master are trading at high secondary market prices, At 100% and 80% above retail respectively.

Vacheron Constantin – Pursuing 'Authentic Value'

Overseas Perpetual Calendar 4300V

© SWISSWATCHES MEDIA GMBH

Meanwhile, Another trend is also noticeable. Brands that are less recognized or liquid than Rolex or Patek Philippe, And thus have relatively lower premiums, Have also performed well this year. Brands that rival in movement technology, Finishing, Story, Or rarity, And even those with overwhelming scarcity, Have shown remarkable transaction value growth. In other words, Collectors preferred watches that stood out for their authentic intrinsic value, Not just liquidity and premium.

222 / © Hodinkee

A representative example is Vacheron Constantin (hereafter 'Vacheron'). During the pandemic, Vacheron ranked third in popularity and recognition among the 'Holy Trinity', But in Q3 this year, Vacheron's transaction volume increased by 24.5% compared to the previous quarter, Surpassing Audemars Piguet (19.4%). In particular, Its transaction value growth rate reached 28%, Nearly five times that of Audemars Piguet (5.9%).

Solaria Ultra Grand Complication with 41 complications

© Revolution Watch

Vacheron's history, Story, And technical prowess are not inferior to Patek Philippe and Audemars Piguet of the 'Holy Trinity' (and in many ways, Even surpass them). The price gap is due solely to lower brand recognition. With an average transaction price of $18, 911, Less than half of Audemars Piguet ($43, 283), This price advantage has been strongly appealing.

Q3 2025 Brand Resale Market Average Price

Note: Q3 2025 average KRW-USD exchange rate 1, 385 KRW applied

Source: EveryWatch

In the same context, The Q3 transaction value growth rates of IWC, Jaeger-LeCoultre, Chopard, And Grand Seiko (42.3%, 29.7%, 62.7%, 63.2% respectively) are also noteworthy. This clearly reflects the market's demand for 'authentic value' (and at the same time, Fatigue with 'hype').

F.P. Journe – The Power of Craftsmanship and Rarity in Independent Makers

Chronomètre à Résonance / © A Collected Man

In line with the pursuit of authentic value, The rise of independent watchmakers has also been impressive. Due to limited supply, These brands are rarely seen in department stores, But they have captivated collectors in the auction market over the past few years.

MB&F Legacy Machine 101 EVO

Greubel Forsey Double Balancier Convexe

© MB&F, Greubel Forsey

While the average price increase rate for all 60 surveyed brands in Q3 was only 2.6%, Leading independent watchmakers enjoyed a spectacular quarter. F.P. Journe recorded 9.0%, MB&F 12.9%, And Greubel Forsey 10.4%, Drawing attention from both seasoned collectors and the broader watch community.

© Courtesy of Phillips

In early December, A unique F.P. Journe watch commissioned by legendary director Francis Ford Coppola of the "Godfather" series was sold at auction for $10, 755, 000 (about 15.85 billion KRW), Setting a new record for the highest price ever paid for an F.P. Journe watch at auction.

© Courtesy of Phillips

Which watch did you purchase in Q3?

As the year ends and Christmas approaches, Which watch would you consider gifting to someone special or to yourself?

David Hwang

Watch Analyst

Watch Terminal