Recently, Rather provocative content on the topic of 'the decline of Rolex' has been spreading across various YouTube and social media channels. If you are an enthusiast interested in both watches and tangible asset investment, You may find some of these claims relatable to a certain extent...

However, That is not the case. Rolex is not a brand that will collapse so easily. On the contrary, I believe it is solidifying its position as a new safe asset, Not just a simple luxury item.

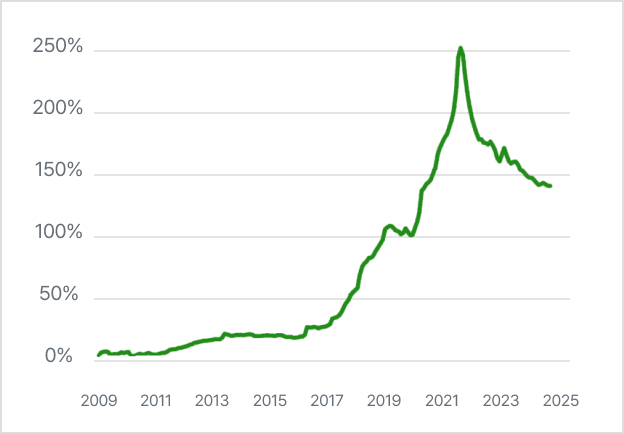

Changes in Rolex Resale Market Prices

© WatchCharts, Watch Terminal

Description: This chart shows the percentage change in market prices since January 2009, Using the prices of the top 30 traded Datejust, Submariner, GMT-Master, And Daytona references.

You may consider this table to be almost identical to the one published in 'The Secret of 3, 000 Trillion Won Why Gold?' last time. The only difference is that 'Rolex' has been substituted for 'gold', Yet its value as an asset is clearly visible.

The True Meaning of a Safe Asset

First, Let us consider what a 'safe asset' means. What does it refer to? Does it have to be free from price volatility to be considered safe?

#1: It Must Not Deteriorate

Submariner Ref. 1680 / © Bonhams

Almost all assets lose value over time. Perishable food, Aging leather bags, Cars that break down more often, And even cash in your account — all of these are assets that 'deteriorate' as time passes.

However, Assets that do not easily deteriorate in physical environments or over time include gold, Certain cryptocurrencies, And Rolex watches.

#2: It Must Be Hypnotic

Rolex Khanjar engraved with the royal emblem of the Sultanate of Oman© Phillips

However, Just because a block of concrete does not deteriorate does not mean it is a safe asset. To clarify, 'deterioration' does not simply refer to physical decay or breakage, But rather to the fading of value or meaning over time. Gold stimulates the human survival instinct with its color and reflection (reminding us of water and the sun), Putting our brains into a 'hypnotic' state. That is why, Even after thousands of years since gold was discovered, We are still fascinated by it.

Rolex (and almost all luxury watches) also provide psychological comfort with their brilliance, Giving the impression that 'life is going well.' Like gold, Rolex has become a symbol of wealth and success.

#3: It Must Be Rare

Daytona Ref. 6263 / © Bonhams

A good tangible safe asset must be somewhat rare. Specifically, The supply should not be easily increased. No matter how good it is, An item that can always be purchased at a store like an Apple Watch does not qualify as a safe asset. This is why vintage stainless steel Daytonas, Which are resistant to discoloration and deterioration and are rare, Are auctioned at higher prices than flashy gold watches. For reference, The estimated production of the popular vintage Daytona Ref. 6263 is about 18, 000 pieces.

Gold, Being an extraterrestrial substance, Has limited supply, And new 'gold rushes' are becoming increasingly difficult. This is similar to how only a limited number of Bitcoins are minted, And mining is becoming more challenging.

© Andrey Rudakov/Bloomberg

In theory, Rolex can be produced infinitely, But it is expected that the shortage of supply compared to demand will continue. This is because for Rolex, Brand value is more important than profit!

Yacht-Master 40 Ref. 226627 made of titanium© Teddy Baldassarre

Yacht-Master 42 226627

42mm, Intense Black, Oyster

Even in the current recession, Rolex maintains an average resale premium of 20 to 30 percent. In addition, By accelerating price increases and introducing buyer screening procedures, The company is strategically maintaining the scarcity of its products.

'Ceratona' Ref. 126500LN / © Fratello

Daytona 126500LN

40mm, White, Oyster

Daytona 126500LN

40mm, Black, Oyster

Rolex Premium TOP 11

The Result? Liquidity

If something is both highly coveted and rare, Its price will rise in the long term, Attracting even more people who want to ride the trend, Resulting in active trading and thus high liquidity. Because it is safe, Trading volume is high, And since it can always be exchanged for other goods or currency, The perception of safety is further reinforced, Creating a virtuous cycle.

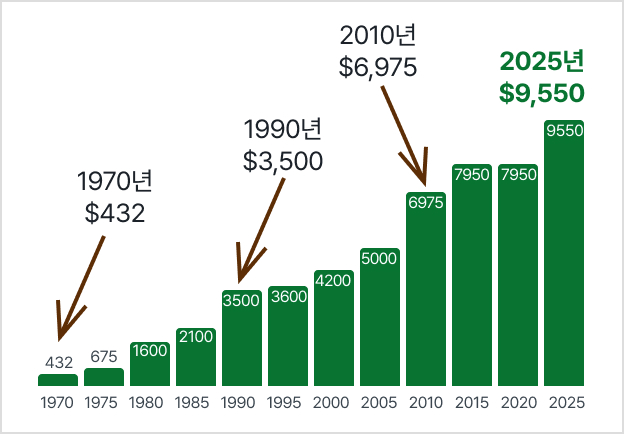

Changes in Datejust Retail Prices (1975 - Present)

© Minus4Plus6, Rolex, Watch Terminal

Description: Based on the combination of 36mm size, Stainless steel case, Fluted bezel, And Jubilee bracelet (reference numbers 1601, 16014, 16234, 116234, 126234).

How High Is Rolex Liquidity?

According to an analysis of actual transaction data from domestic companies, It takes as little as 3 days and as much as 18 days (average 9 days) for major products to sell, While in the global market it is about 14 to 20 days. The domestic market can be considered to have relatively higher liquidity.

Lady-Datejust 28 Ref. 279173© Rolex

On VIVER, Transactions for the Lady-Datejust 28 model are completed in an average of 4 days. This model, Which is very popular as a wedding gift, Currently has more than 250 different variations, But it is difficult to find in retail stores. As a result, Many buyers are turning to the resale market to find the model they want.

Lady-Datejust 28 279173

28mm, Silver/Diamond, Jubilee

Lady-Datejust 28 279171

28mm, Chocolate/Diamond, Jubilee

On the other hand, You may think that transactions take a long time, But there are important points to recognize.

1. Like gold or Bitcoin, Rolex cannot be traded in fractions. In other words, You cannot buy just 0.1 of a Rolex.

2. The average market price of a Rolex is about 27 million KRW, Which is 4 to 5 times the average monthly income in Korea, And more than twice the average in the United States. This means it is not an amount that can be 'easily' purchased.

3. Apart from being a luxury item, There are no other practical uses.

Nevertheless, The fact that transactions can be completed in as little as 3 days demonstrates incredible liquidity, Does it not?

GMT-Master II / © Wrist Aficionado

Rolex Has Already

Become a New Safe Asset

Gold-Rolex Price Ratio Trends

© WatchCharts, Watch Terminal

Description: When discussing silver prices, The gold-silver price ratio is often mentioned. In a similar context, I directly calculated the ratio of gold prices to the market prices of major Rolex models. Conclusion!: Compared to gold, The representative safe asset, The price of Rolex, The second safe asset, Has returned to the 2013 level, When people started saying 'Rolex has become rare.'

GMT-Master 2 126710BLRO

40mm, Black, Jubilee

GMT-Master 2 126710BLNR

40mm, Black, Jubilee

GMT-Master 2 126710GRNR

40mm, Black, Jubilee

There are those who recognized this early and acted quickly. People who flip for quick profits, Investors who include rare Rolexes in their portfolios, And those who want to secure tangible assets with guaranteed liquidity for future generations.

You may not agree with everything I have said, But one thing is clear. The value of Rolex is likely to be higher in the long term than the cash currently in your account.

David Hwang

Watch Analyst

Watch Terminal